The Best Home and Auto Insurance Bundle

Table of Content

Having a multi-policy discount on your auto and home insurance does not preclude you from applying other discounts to maximize your savings. Utilizing other discounts that you qualify for might help you save additional money on your premium. Rates are based on our analysis of 2022 sample home insurance quotes from across the country provided by Quadrant Information Services. Actual rates will vary based on location, policy limits, coverages, claims history, and other factors.

Over the last three years, she has covered insurance providers, coverage, costs of insurance, and more at MoneyGeek, Bankrate, and The Simple Dollar. Although available only to retired or active military members and their eligible families, USAA has a range of coverage options and high customer service scores for drivers and homeowners who qualify. Root, only offer car insurance, so you can’t bundle home insurance coverage. Best homeowners insurance companies on the market, and we’ll highlight our top picks for bundling insurance. Allstate is neck and neck with State Farm for the best bundle. Both have great customer satisfaction ratings, but Allstate is not quite as affordable on average due to a lower bundle discount.

Best cheap homeowners insurance in San Diego

Then, you can calculate the percentage of your overall bundling savings. In the example below, you’ll see the overall home and car insurance bundle discount is 23%. Since most insurers offer discounts for bundling home and auto insurance, there is a good chance you can save money by bundling the two. Additionally, going through the same insurer for both home and auto can make communication easier. That being said, it’s possible that your cheapest option is to have home and auto insurance through different companies.

We determined the following companies to be the best companies for home and auto insurance bundles. Bundling home and auto insurance means that you’re purchasing both policies from the same company. Insurance providers use bundling discounts to incentivize customers to buy all of their insurance policies from the same carrier.

Benefits of Bundling Insurance

Before making your purchase decision, keep in mind that Nationwide scored below the industry average in J.D. Home Insurance Study for customer satisfaction, showing that some policyholders may not have been satisfied with their experience. However, Nationwide has an A+ financial strength rating from AM Best. Choosing the best home and auto insurance bundle is important because you might stay with the insurer for many years. Many companies offer multi-policy discounts, but it’s also important to get the right coverage and have reliable customer service.

Continue sharing the lowest offer until you discover where the price floors really are. What combined figure are you currently paying for home and auto? Have this number handy so you can rapidly compare bundle rates. Likely in an effort to attract younger buyers, State Farm’s renter’s insurance rates compete even with online-only providers like Lemonade. Liberty Mutual’s premium rates start out notoriously high but tend to quickly fall within a competitive range once you chisel away at them with their laundry list of discounts. There are other ways to lower costs on your insurance coverage, in addition to bundling.

How can I pay for my Multi Cover policy?

That means you'd need a bundle discount of at least $400 or so to lower the total bundle rate enough to save money compared to the price you currently pay for separate policies. Just because one company offers cheap car insurance does not mean they will also offer affordable rates for homeowners insurance, and vice versa. Progressive offers numerous products that could help you bundle more than just your home and auto coverage, making it easier to manage your insurance and save money. Allstate could be a great choice for drivers and homeowners looking to bundle policies and personalize their coverage.

The majority of big insurance companies do not charge cancellation fees, but we've found that some, like Esurance and Mercury, charge a fee for canceling before your policy is up. Power, customers with bundled policies traditionally tend to be more satisfied with their insurer than those without bundled policies. Car and home insurance quotes for your area by entering your ZIP code above.

Potential Savings

State Farm has the biggest auto and home bundling discount among national companies, with an average savings of 25%. For example, usually at the end of the auto insurance quote process, your insurer will ask if you wish to add a homeowners policy as well. Reviews.com chose these carriers based on our research metrics.

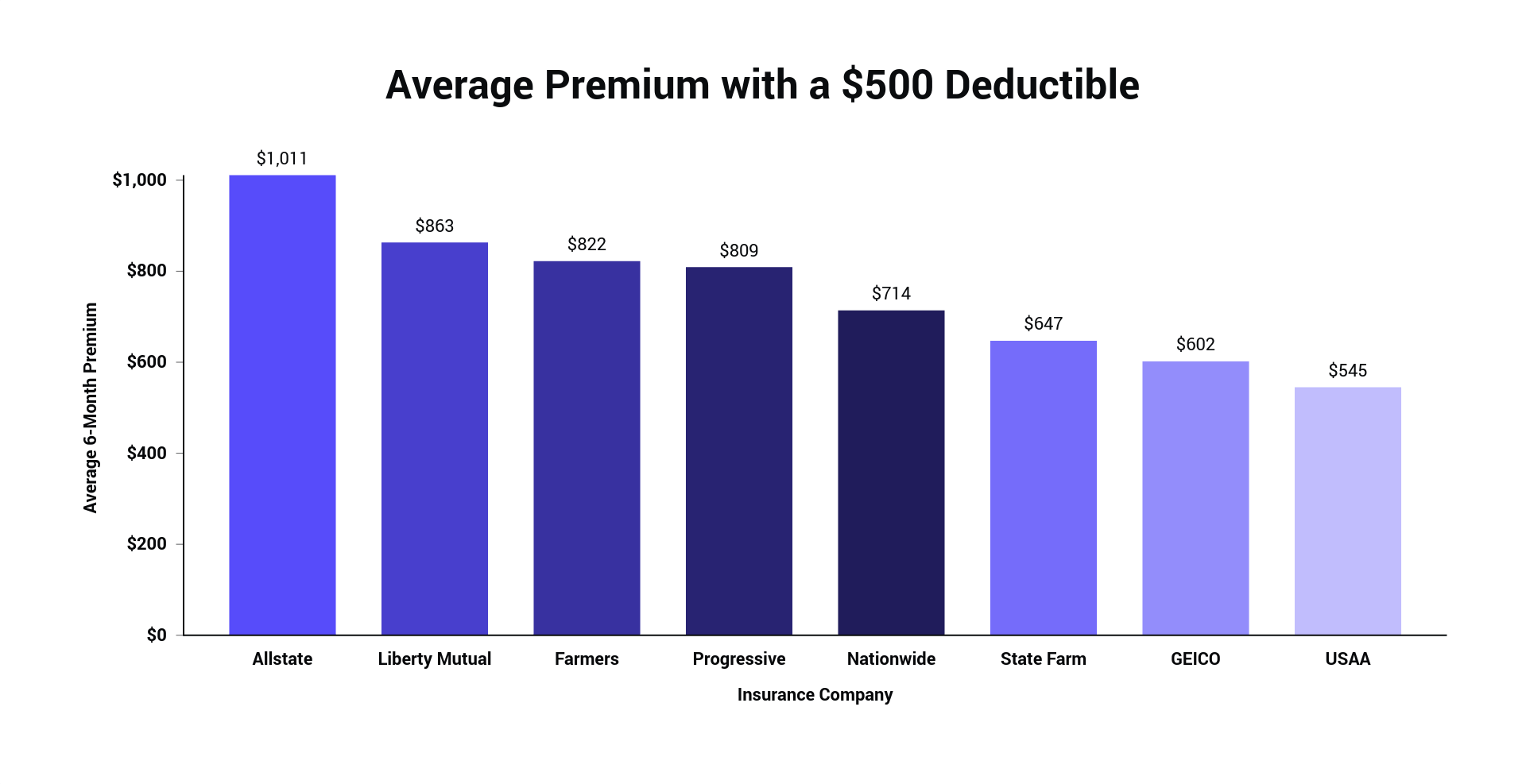

The following table illustrates the amount you could potentially save on your auto insurance by bundling policies with some of the largest U.S. insurers. Bundling is when you buy multiple types of coverage, like home and auto insurance, from one insurance company. Combining home and auto insurance might make you eligible for a discount. The best home and auto insurance bundles are currently offered by Liberty Mutual, Allstate, Progressive, and State Farm. These providers have a wide range of special discounts for different policyholders, a number of bundle types, and superior claim processing.

Premiums, product information and inclusions should be confirmed with the relevant insurance provider. Please ensure that you read the product disclosure statement to determine all the current options and inclusions for the product you are considering. Canstar compares a range of car insurance policies based on both price and features. You can compare policies using our comparison tables and you might also like to view the results of our latest Car Insurance Star Ratings and Awards.

Still, the savings surely exist, and you can find out how much by calling an insurance agent. In addition to multi-policy discounts, Progressive also issues discounts for multiple cars, as well as loyalty discounts that even apply to the time you were with your previous insurer. This gives you an extra incentive to switch from a previous insurer, especially if they’re giving you a discount for being a longtime customer.

If you have specific needs for your home insurance, bundling may not be an option for you. For instance, if your home policy was switched to a high-risk home insurance company after making a personal liability claim, you may not have an option to bundle your auto policy. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

You'll also prevent any coverage gaps between the canceled policy and the new one. There may be other perks as well when you bundle auto and home insurance, depending on the company and state you live in. For example, Safeco offers customers who bundle a single-loss deductible. That means, if your car is damaged in the same event that damages your home, such as a fire, your car insurance deductible is waived after your homeowners deductible has been paid.

Some auto insurance companies don't write homeowners insurance, but some may align themselves with a home insurer to offer a discount. Ask your agent or customer service representative to see if you can bundle multiple insurance policies. For instance, Allstate insureds can save up to 25% when bundling home and auto together.

The final insurance policy premium for any policy is determined by the underwriting insurance company following application. The table below displays a selection of the insurers and products in Canstar’s database that are offering multi-policy discounts on car insurance at the time of writing. Before applying for a policy, consider checking with the insurer to confirm the details of the offer, including any additional terms and conditions that may apply. Policygenius, an insurance marketplace, makes finding the best home and auto insurance bundles easier than ever. After going through Policygenius’s quick application, a handful of lenders will be presented to you with rates and terms laid out in easy-to-read language.

Komentar

Posting Komentar